Illinois Car Trade-In Tax Changes

Illinois will impose a car trade-in tax on January 1, 2020. The state currently collects no sales tax on your car's trade-in value, which has acted as credit towards a new vehicle purchase. Sales tax only applies to the difference between the determined trade-in value and the new vehicle purchase price. However, starting January 1st, state and local sales tax will be applied to any trade-in value above $10,000. You can save hundreds and thousands by trading in your car this year instead of waiting until 2020!

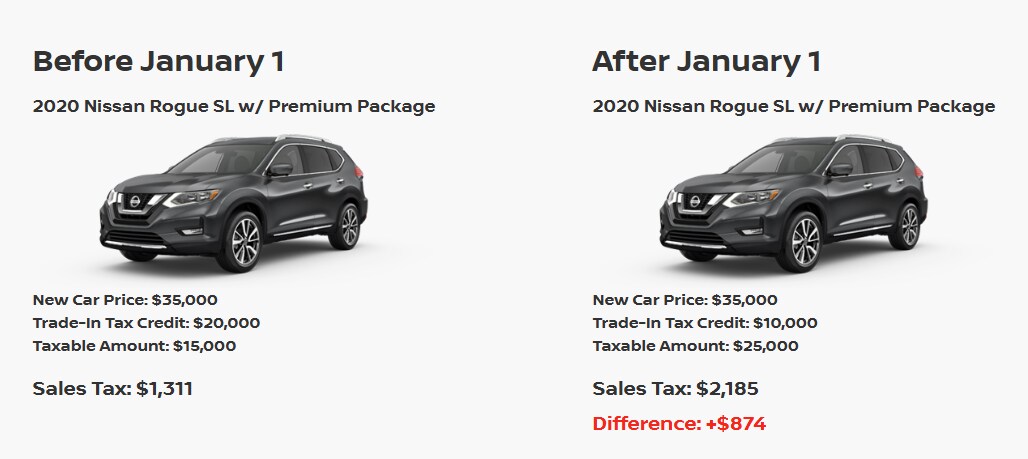

How is the Illinois Trade-In Sales Tax Law Changing in 2020?

For example, you are an Illinois resident looking to purchase a new vehicle at a $35,000 sale price and your car is valued at $20,000. In 2019, you would only pay sales tax on the $15,000 difference. Combining state and local taxes this is around 8.75%. Before January 1st, this total would be $1,311. Shift to 2020, the trade-in tax credit of $10,000 will also be taxed plus the $15,000 difference. This results in 8.75% of $25,000 being taxed in this transaction at a total of $2,185. This is $874 more you will have to pay in 2020 for the same purchase.

For more details, contact our team and learn about how much we can save you before 2020. Looking for an online trade-in appraisal? Value your trade with our team from the comfort of your home now. Our team is available at 866-800-1100 or visit our dealership in Skokie, IL today.

AdChoices

AdChoices